Pet ownership in America has changed. Pets are no longer just animals living in our homes. They’re family. And when family members get sick or injured, we don’t hesitate to seek the best care available. The problem is cost. Veterinary bills in the United States have climbed steadily, and advanced treatments that once seemed rare are now common.

That’s where pet insurance in USA enters the picture.

In 2026, pet insurance isn’t a luxury or a niche product. It’s becoming a practical financial tool for responsible pet owners. But choosing the right plan is not simple. Policies differ wildly. Fine print matters. And flashy ads don’t always tell the full story.

Let’s break it down. This guide walks you through how pet insurance works in the US, what’s changed in 2026, and which providers stand out right now, without hype or vague promises.

Why Pet Insurance in USA Matters More Than Ever

4

Here’s the thing. Veterinary medicine has advanced fast. MRIs, cancer treatments, orthopedic surgeries, and long-term medications are now routine. That’s good news for pets. It’s also expensive.

A few real numbers put things in perspective:

- Emergency surgery can run $3,000 to $7,000

- Cancer treatment often exceeds $10,000

- Chronic conditions like diabetes or arthritis can cost thousands every year

Most American households are not prepared for that kind of surprise expense. Pet insurance in USA fills that gap. It allows owners to say yes to treatment based on what’s best for the animal, not what’s cheapest.

In 2026, insurers are also improving coverage options. Wellness add-ons, faster claims, and broader acceptance of older pets are becoming more common.

How Pet Insurance in USA Actually Works

Pet insurance doesn’t work like human health insurance. There’s no direct billing in most cases. Instead, you pay the vet first, submit a claim, and get reimbursed.

Here’s the basic structure:

- Monthly premium

What you pay every month to keep coverage active - Deductible

The amount you pay out of pocket before reimbursement kicks in - Reimbursement rate

Usually 70%, 80%, or 90% of eligible costs - Annual or lifetime limits

The maximum amount the insurer will pay

Coverage generally includes:

- Accidents

- Illnesses

- Surgeries

- Hospitalization

- Diagnostic tests

- Prescription medications

What it usually does not include:

- Pre-existing conditions

- Cosmetic procedures

- Breeding-related care

Understanding these basics makes comparing pet insurance in USA far easier.

What’s New With Pet Insurance in USA for 2026

The pet insurance market has matured. In 2026, several trends stand out:

- Higher annual limits, including unlimited plans

- Faster claim processing, often within days

- Expanded coverage for older pets

- Optional wellness and preventive care add-ons

- Better mobile apps and digital claim tracking

Competition has pushed insurers to simplify policies and improve transparency. That’s good for consumers, but only if you know what to look for.

Best Pet Insurance Providers in USA 2026

4

Below are the top providers for pet insurance in USA in 2026, based on coverage quality, pricing flexibility, claim experience, and reputation.

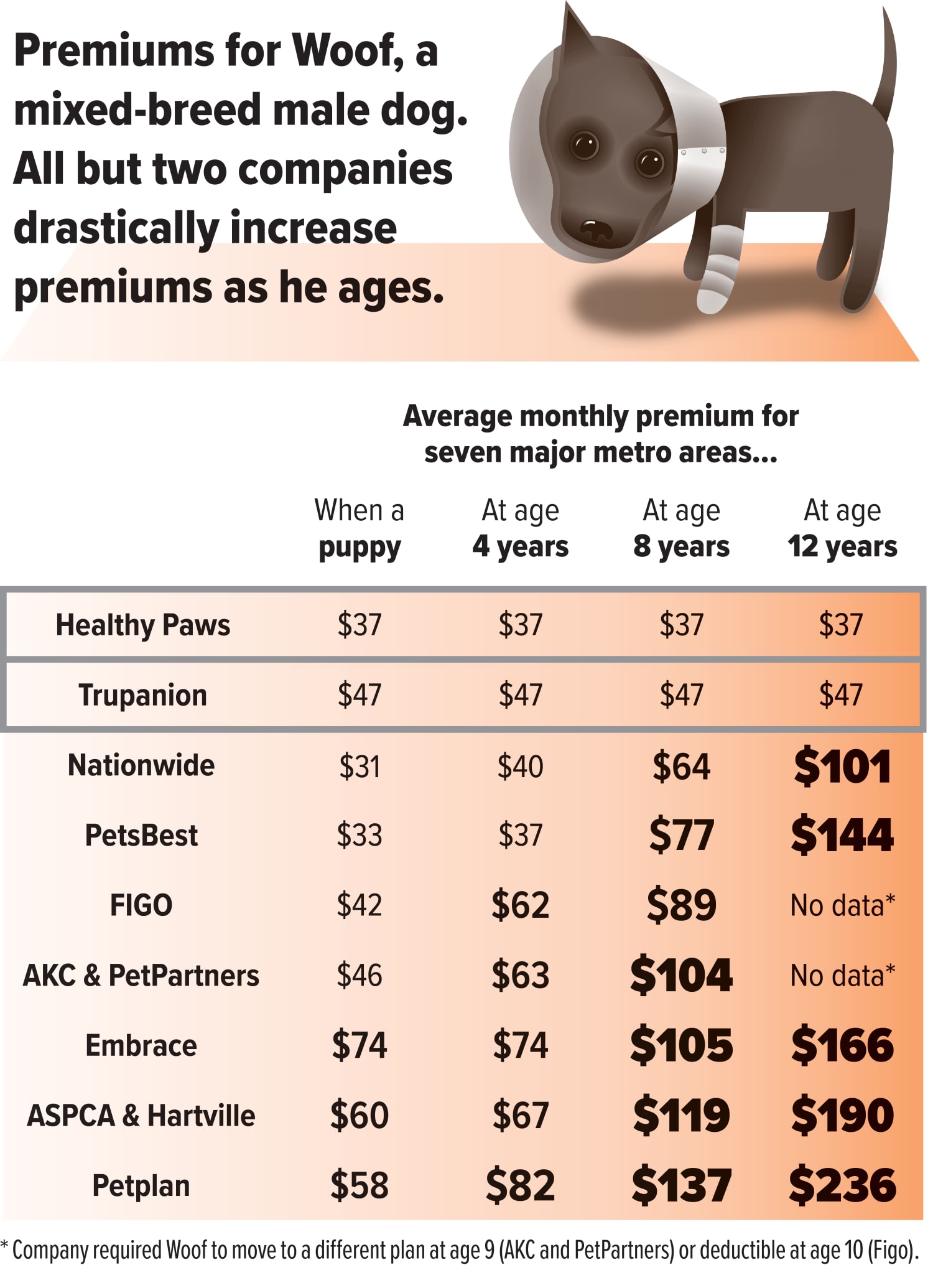

Healthy Paws

Healthy Paws remains a leader for one reason: simplicity.

Why it stands out

- Unlimited lifetime benefits

- Fast claims processing

- Covers alternative treatments like chiropractic care

Things to know

- No wellness plans

- Premiums increase with age

Healthy Paws works best for owners who want strong accident and illness coverage without distractions.

Lemonade Pet Insurance

Lemonade brings a modern, app-first approach to pet insurance in USA.

Why it stands out

- Affordable base plans

- Customizable coverage

- Excellent mobile experience

Things to know

- Requires bundling with renters or homeowners insurance in some states

- Newer to pet insurance than some competitors

For tech-savvy owners who want control and transparency, Lemonade is hard to ignore.

Embrace

Embrace offers some of the most flexible plans in the market.

Why it stands out

- Adjustable deductibles and reimbursements

- Wellness rewards program

- Covers behavioral therapy

Things to know

- Annual limits apply unless you choose higher tiers

- Slightly more complex policies

Embrace is ideal if you want to fine-tune coverage around your budget.

Trupanion

Trupanion focuses on serious medical care.

Why it stands out

- No payout limits

- Direct vet payments at participating clinics

- Per-condition deductibles

Things to know

- Higher premiums

- No wellness coverage

Trupanion is popular among owners of breeds prone to genetic conditions.

Nationwide Pet Insurance

Nationwide is one of the oldest names in pet insurance in USA.

Why it stands out

- Exotic pet coverage

- Comprehensive wellness options

- Wide availability

Things to know

- Benefit schedules on some plans

- Claims may take longer

Nationwide works well for households with multiple or unusual pets.

Comparing Pet Insurance in USA: What Actually Matters

Price alone doesn’t tell the story. Here’s what deserves your attention.

Coverage Depth

Does the policy cover chronic conditions? Genetic issues? Cancer treatments?

Deductible Structure

Annual deductibles reset once per year. Per-condition deductibles can be better for long-term illnesses.

Reimbursement Speed

Waiting weeks for reimbursement defeats the purpose.

Exclusions

Read the list. Carefully. Pre-existing conditions are standard exclusions, but definitions vary.

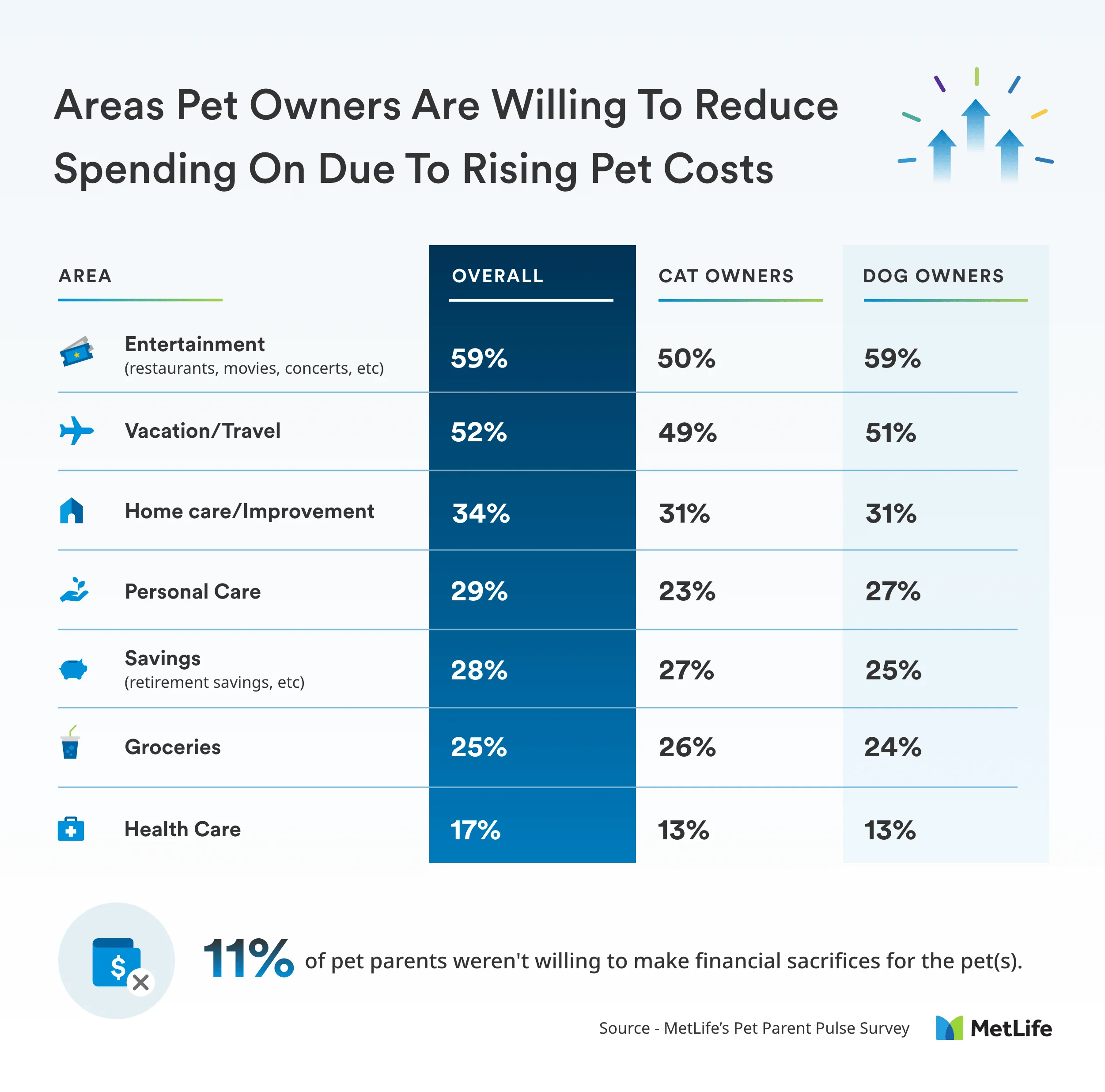

Pet Insurance for Dogs vs Cats in USA

Dogs usually cost more to insure. They’re more accident-prone and tend to develop breed-specific issues.

Cats, on the other hand, are cheaper to insure but often underinsured. Indoor cats still face risks like urinary blockages or kidney disease.

In both cases, enrolling early reduces exclusions and lowers premiums long-term.

Is Pet Insurance in USA Worth It?

Let’s be honest. Some owners will never file a major claim. Others will save tens of thousands of dollars.

Pet insurance makes sense if:

- You want predictable expenses

- You’d struggle with large emergency bills

- Your pet is young, active, or breed-prone to illness

It’s less useful if:

- You have a large emergency fund

- Your pet is already elderly with known conditions

For most Americans, though, pet insurance in USA provides peace of mind that’s hard to price.

Common Mistakes Pet Owners Make

- Waiting too long to enroll

- Ignoring exclusions

- Choosing the cheapest plan blindly

- Skipping dental and chronic care coverage

- Assuming all vets accept direct billing

Avoid these, and you’re already ahead.

How to Choose the Best Pet Insurance in USA for Your Needs

Ask yourself:

- Can I handle a $5,000 surprise bill?

- Does my pet have breed-specific risks?

- Do I want wellness coverage or just emergencies?

- How much paperwork am I willing to deal with?

The right plan balances cost, coverage, and convenience.

The Future of Pet Insurance in USA

By 2030, pet insurance adoption is expected to double. AI-driven diagnostics, genetic testing, and personalized premiums are already on the horizon.

In 2026, though, the biggest advantage remains simple: financial freedom to care for your pet properly.

Final Thoughts

Pet insurance in USA is no longer optional for many households. It’s a practical response to rising veterinary costs and better medical options for pets.

The best plan isn’t the most expensive or the most advertised. It’s the one that fits your pet’s life and your financial reality.

Take your time. Read the fine print. And choose with clarity.

Your pet depends on you.